When you walk into a clinic or urgent care center, you rarely think about how much the staff paid for the antibiotics, lidocaine, or saline bags they’re handing out. But behind the scenes, bulk purchasing of generic medications is quietly reshaping how healthcare providers manage costs-and saving them thousands every month. For small practices, hospitals, and state Medicaid programs, buying large quantities of off-patent drugs isn’t just smart business-it’s often the difference between staying open and cutting services.

Why Bulk Buying Generic Drugs Makes Financial Sense

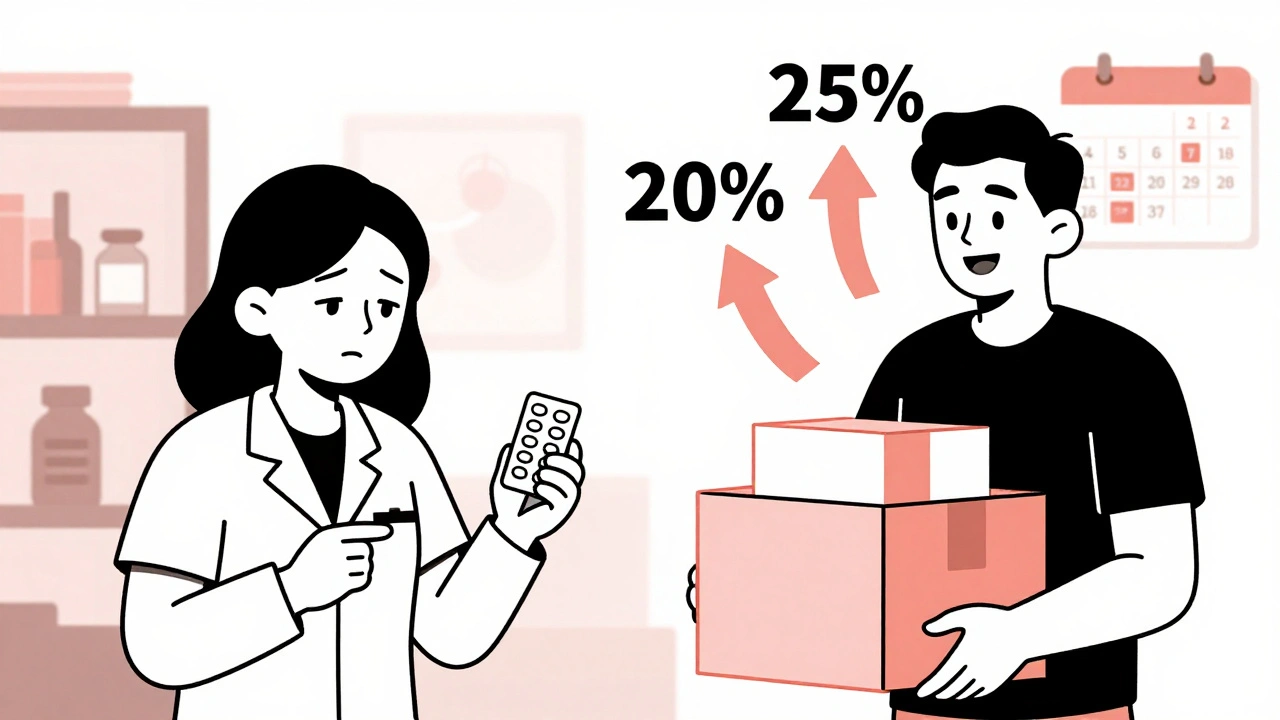

Generic drugs make up over 90% of all prescriptions filled in the U.S., yet they account for only about 25% of total drug spending. That gap isn’t an accident. It’s the result of a system built to reward volume. When a provider buys 10,000 units of amoxicillin instead of 500, the price per pill drops dramatically. Manufacturers and distributors offer steep discounts because moving large volumes reduces their own handling, shipping, and administrative costs. These savings get passed down, but not always evenly. The key is understanding how those discounts work. There are three main types: direct volume discounts, rebate agreements, and short-dated stock deals. Direct discounts kick in when you order over 1,000 units of a drug-think 5% to 15% off the list price. For orders over 10,000 units, discounts can hit 20% to 30%. These are straightforward: buy more, pay less. Rebates are trickier. Pharmacy Benefit Managers (PBMs) negotiate these with manufacturers, promising to push more of a drug through their network in exchange for cash back. The catch? PBMs don’t always pass the full rebate to the provider or patient. Studies show only 50% to 70% of those rebates actually reach the plan sponsor. That means a 30% rebate might only translate to a 15% cost cut for the clinic. Then there’s short-dated stock-medications with six to twelve months left before expiration. These are often sold at 20% to 30% off because distributors want to move them before they expire. For high-turnover drugs like injectables, this is a goldmine. One Texas urgent care center cut its injectable costs by 20% in two months by switching 60% of its lidocaine and antibiotic orders to short-dated stock. The trick? You need to use it fast. Waste becomes a real risk if you overbuy.Who’s Buying Bulk-and How Much Do They Save?

Not all buyers get the same deals. Primary wholesalers like McKesson, Cardinal Health, and AmerisourceBergen control 85% of the U.S. drug distribution market. But they rarely offer deep discounts to small practices. Their bulk pricing is designed for hospitals and large chains. Independent clinics and urgent care centers often pay list price-or close to it. That’s where secondary distributors like Republic Pharmaceuticals come in. These companies specialize in serving smaller providers. They buy in bulk from manufacturers, then resell at lower prices with fewer restrictions. Providers using secondary distributors report savings of 20% to 25%, compared to just 3% to 8% with primary wholesalers. Why? Because secondary distributors don’t have the same overhead. They focus on high-volume generics, not specialty drugs or complex logistics. State Medicaid programs get their own kind of leverage. Through multi-state purchasing pools like the National Medicaid Pooling Initiative (NMPI) and the Sovereign States Drug Consortium (SSDC), states band together to negotiate as one giant buyer. A single state might save 1% to 2% on generics. But when 47 states pool their buying power, they hit 3% to 5% savings. That adds up fast-$99.4 million in extra savings since 2016 for the National Pharmaceutical Discount Consortium alone. Employers and private insurers also benefit, but unevenly. A 2023 report found that while generics make up 90.2% of prescriptions, they only account for 24.7% of total drug spending. That means most of the money spent on drugs goes to the 10% of prescriptions that are still branded. Bulk purchasing helps keep those branded drug costs from exploding.

The Hidden Costs and Pitfalls of Bulk Buying

It’s not all savings and success stories. Bulk purchasing comes with real operational headaches. The biggest? Cash flow. Buying 10,000 units of a drug means paying upfront for inventory that might sit on a shelf for weeks. A 2023 MGMA analysis found that practices need 15% to 25% more working capital to handle bulk orders. That’s tough for small clinics with tight budgets. Minimum order requirements are another trap. Some distributors force you to buy 5,000 units of a drug just to get the discount-even if you only need 800. You end up paying for inventory you don’t need, which ties up money and risks expiration. Inventory management becomes critical. Short-dated stock is great for savings, but if you don’t track expiration dates closely, you’ll throw away expensive meds. One Ohio clinic manager reported a 25% cut in injectable costs-but only after staff spent 20 hours in the first month learning how to rotate stock and forecast usage. That’s a lot of time for a small team. And then there’s availability. Even with bulk buying, drug shortages still happen. As of November 2023, the FDA listed 298 active shortages of generic drugs. If your main supplier runs out of metformin or insulin, you can’t just order more from someone else overnight. You’re stuck waiting-or paying list price from a last-resort vendor.How to Start Bulk Purchasing Without Overwhelming Your Team

You don’t need a pharmacy department to start saving. Here’s how to do it step by step:- Identify your top 15-20 drugs. Look at your prescription logs. Which generics do you use most? Lidocaine, amoxicillin, prednisone, saline, and metformin are common candidates. These usually make up 60% to 70% of your medication spend.

- Find a secondary distributor. Look for companies that specialize in serving small providers. Republic Pharmaceuticals, for example, offers clear pricing, no hidden fees, and no minimums for most items. Compare their catalog to your current wholesaler’s.

- Start with short-dated stock. Pick one high-use drug and try buying a batch with six months left on the expiration date. You’ll likely save 20% or more. Track how quickly you use it.

- Set up a simple tracking system. Use a spreadsheet or your EHR to log expiration dates and usage rates. Update it weekly. You’ll avoid waste and know when to reorder.

- Scale gradually. After three months, add another drug. Don’t try to switch everything at once. Give your team time to adjust.

What’s Changing in 2025-and What It Means for You

The rules are shifting. The Inflation Reduction Act’s Medicare drug price negotiation program is now in effect. Starting in 2026, Medicare will directly negotiate prices for 10 high-cost drugs, with projected savings of $6 billion that year. These negotiated prices are 38% to 79% below list prices. While this targets branded drugs first, it’s creating ripple effects. Manufacturers are now more willing to offer deeper discounts on generics to stay competitive. PBMs are also changing. As of January 2024, the top three PBMs all offer integrated point-of-sale discount programs. That means when a pharmacist fills a prescription for atorvastatin or metformin, the discounted price applies automatically-no discount card needed. This cuts out middlemen and gets savings directly to patients. The FTC is also cracking down. As of November 2023, they had 17 active investigations into firms manipulating drug prices. If these lead to new transparency rules, the opaque rebate system could shrink-making bulk discounts more predictable and fair. The future? Bulk purchasing won’t disappear. But it will evolve. Secondary distributors will keep growing. Primary wholesalers may start offering better deals to stay relevant. And more providers will realize: if you’re buying generics in bulk, you’re not just saving money-you’re taking back control from a broken system.Is Bulk Purchasing Right for Your Practice?

Ask yourself these questions:- Do you use at least 5 generic drugs regularly (100+ units per month)?

- Do you have staff who can track expiration dates and reorder on time?

- Can you handle a larger upfront payment for inventory?

- Are you tired of paying list price for drugs you use every day?

Can small clinics really save money by buying generics in bulk?

Yes. Even small clinics can save 15% to 25% on high-use generics like lidocaine, antibiotics, and saline by switching to secondary distributors or buying short-dated stock. One Texas urgent care center cut its injectable costs by 20% in just two months by changing how it ordered common medications.

What’s the difference between a primary wholesaler and a secondary distributor?

Primary wholesalers (McKesson, Cardinal Health, AmerisourceBergen) serve large hospitals and chains and rarely offer deep discounts to small practices. Secondary distributors like Republic Pharmaceuticals focus on small providers and offer better prices-often 20% to 25% off-with fewer restrictions and simpler ordering.

Are rebates from PBMs worth it for my practice?

Not always. PBMs negotiate rebates of 15% to 40% on generics, but they keep 30% to 50% of those savings for themselves. If you’re not getting direct discounts from your supplier, you’re probably not seeing the full benefit. Focus on direct volume discounts and short-dated stock instead.

What if I can’t afford to buy 10,000 units of a drug at once?

You don’t need to. Many secondary distributors offer bulk pricing on orders as low as 1,000 units. And short-dated stock often comes in smaller batches-sometimes just 500 to 2,000 units-with the same 20% to 30% discount. Start small and scale as you get comfortable.

How do I avoid wasting expired drugs when buying short-dated stock?

Track expiration dates religiously. Use a simple spreadsheet or your EHR to flag drugs with less than six months left. Prioritize using them first. Successful practices spend 5-10 hours a month on this and achieve 95%+ usage rates with zero waste.

Will drug shortages affect my bulk purchasing plan?

Yes. As of November 2023, there were 298 active generic drug shortages. Bulk purchasing works best for stable, high-demand drugs like antibiotics and saline. Avoid locking in large orders for drugs with frequent shortages. Always have a backup supplier.

If you’re paying full price for generics you use every week, you’re leaving money on the table. The tools to save are already here. You just need to use them.

Comments (12)