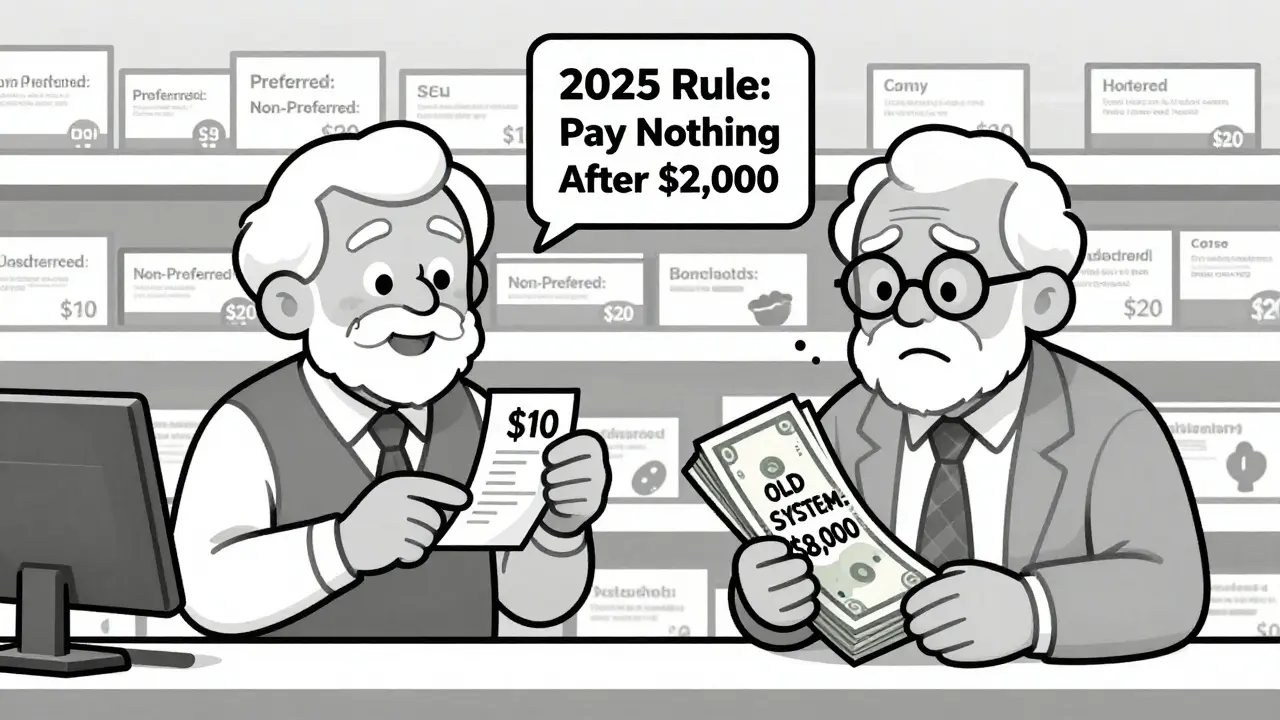

If you’re on Medicare and take generic drugs, 2025 changed everything. The new rules mean you could pay zero for your prescriptions after hitting a $2,000 out-of-pocket cap - a massive shift from the old system where seniors sometimes spent over $8,000 just to get to catastrophic coverage. This isn’t theoretical. Real people are saving hundreds, even thousands, per year just by switching to generics and understanding how their Part D plan works now.

What Changed in Medicare Part D for Generics?

Before 2025, Medicare Part D had a coverage gap - the infamous "donut hole" - where you paid full price after hitting a certain spending threshold. Even if you were only taking low-cost generics, you still had to spend nearly $8,000 out of pocket before your plan kicked in fully. That meant someone on three or four daily generic meds could be paying $100 a month for years before getting relief. The Inflation Reduction Act of 2022 fixed that. Starting in 2025, the out-of-pocket cap for all Part D drugs - brand-name or generic - is now $2,000. Once you hit that number, you pay nothing for the rest of the year. That’s a 75% drop in maximum spending. And here’s the kicker: every copay, deductible, and coinsurance payment counts toward that cap. Even manufacturer discounts you get on generics count. That wasn’t true before.How Much Do Generics Actually Cost Now?

Most Medicare Part D plans put generics in the lowest tier, meaning the cheapest copay. In 2025, the median copay for a 30-day supply of a preferred generic is about $10. For non-preferred generics, it’s closer to $20. But if you’re on a low-income subsidy (Extra Help), your copay could be as low as $0 to $4.50. Here’s the real win: if your monthly generic meds cost $40, and you take them for 12 months, you’d spend $480 before hitting the $2,000 cap. That’s it. After that, your next 12 months of generics? Free. No more surprise bills. No more choosing between meds and groceries. Compare that to the old system: you’d pay $480, then hit the gap and pay full price - often $150-$200 a month - until you spent another $7,500. That’s $8,000 total just to get to free drugs. Now? You’re there in less than half the time.Part D Plans: PDPs vs. MA-PDs

You have two main ways to get Part D coverage: a standalone Prescription Drug Plan (PDP) or a Medicare Advantage Plan with drug coverage (MA-PD). The big difference? Price. PDPs average $39 a month in premiums. MA-PDs? Just $7. That’s a sixfold difference. But here’s the catch: both types have nearly identical generic copays. So if you’re mainly taking generics, you’re better off with an MA-PD. You get the same drug coverage, plus extra benefits like dental or vision, for way less money. But not all MA-PDs are equal. Some have tighter formularies - meaning they might not cover your specific generic version. Always check your plan’s formulary. Just because a drug is generic doesn’t mean your plan will cover it without prior authorization or step therapy.

Why You Might Still Pay More Than Expected

The system looks simple on paper. But in practice, confusion is common. About 41% of beneficiaries don’t fully understand what counts toward the $2,000 cap. Premiums don’t count. Manufacturer coupons don’t always count unless they’re part of the plan’s negotiated price. And some plans still use step therapy - forcing you to try a cheaper generic first before covering the one your doctor prescribed. A 2024 survey by Medicare Rights found a 23% spike in calls from people whose generic meds were switched without notice. One woman on a blood pressure generic got her prescription changed to a different generic with a $15 higher copay. She didn’t realize until her next refill. That’s not rare. About 27% of Part D plans now require step therapy for at least 15 classes of generic drugs. And while most plans cover two generics per class, they often favor the cheapest one - even if it’s less effective for you. Your doctor can override it, but you have to ask. Don’t assume your plan will automatically cover the one you’ve been on.Who Saves the Most?

The biggest savings go to people taking multiple generics daily. Someone on five generics at $10 each = $50 a month. In a year, that’s $600. At $2,000 cap, you’re there in 33 months - so after 2 years and 9 months, you’re paying $0. That’s over $1,000 saved in the second year alone. Low-income beneficiaries on Extra Help save even more. They pay $0 deductible, $0-$4.50 copays, and skip the coverage gap entirely. For them, the $2,000 cap is almost irrelevant - they’re already getting the best deal possible. But here’s the overlooked group: people on high-cost generics. Drugs like insulin glargine or levothyroxine have generic versions, but they’re still priced higher than typical generics. Even with the cap, those people might hit the $2,000 limit faster - and benefit more.How to Find the Best Plan for Your Generics

Don’t just stick with your current plan because it’s familiar. Every October, Medicare opens enrollment. Use the Medicare Plan Finder tool. Type in your exact medications - brand and generic names - and filter by cost. Look at the total annual cost: premiums + copays + estimated out-of-pocket spending. If you’re on a single generic, a low-premium MA-PD might be best. If you’re on multiple generics, compare total out-of-pocket costs. A plan with a $30 premium but $5 copays might beat a $5 premium with $20 copays. Also, check if your plan has a preferred pharmacy network. CVS, Walgreens, and Walmart often have lower copays for generics. Some plans even offer mail-order discounts for 90-day supplies.What’s Coming Next?

In 2026, a new program called the Selected Drug Subsidy Program will start. It gives Part D plans a 10% subsidy if they cover certain high-cost generics. That could mean lower copays for drugs like semaglutide generics or complex hormone replacements. Biosimilars - generic versions of biologic drugs - are also gaining ground. While not traditional generics, they’re cheaper and covered under Part D. By 2028, they could make up 35% of the biologic market, adding another layer of savings. But the biggest threat? Drug price inflation. If prices keep rising at 5% a year, the $2,000 cap might not stretch as far. The Congressional Budget Office warns that without more reforms, Medicare’s reinsurance system could become unsustainable by 2035.What You Should Do Now

1. Check your current plan’s formulary. Make sure your generics are covered and in the lowest tier. 2. Use the Medicare Plan Finder. Compare plans based on your exact meds, not just premiums. 3. Ask your pharmacist. They know which generics are preferred and if there’s a cheaper alternative. 4. Apply for Extra Help if you qualify. Even if you think you don’t, it’s worth applying. The income limits are higher than most people realize. 5. Track your spending. Keep receipts. Know how much you’ve paid so far toward the $2,000 cap. Your plan sends a statement every month. The system isn’t perfect. But for the first time, taking generics under Medicare Part D actually saves you money - big time. You don’t need to be a pharmacist or a policy expert. Just know your meds, check your plan, and don’t assume anything. The savings are real. And they’re waiting for you.Do generic drugs work as well as brand-name drugs under Medicare Part D?

Yes. The FDA requires generics to have the same active ingredients, strength, dosage, and effectiveness as brand-name drugs. The only differences are in inactive ingredients like fillers or color - which don’t affect how the drug works. Medicare Part D plans cover generics because they’re proven safe and effective, and they save billions in costs.

Does the $2,000 out-of-pocket cap include my monthly premiums?

No. Only what you pay at the pharmacy - deductibles, copays, and coinsurance - counts toward the $2,000 cap. Your monthly premium is separate and doesn’t help you reach the cap faster. That’s why it’s critical to focus on out-of-pocket drug costs, not just plan premiums.

Can my Medicare Part D plan switch my generic drug without telling me?

Yes, but only under certain rules. Plans can change which generic version they cover - called therapeutic substitution - if they notify you in advance. Many do this to lower costs. But if your doctor says a specific generic is medically necessary, they can request an exception. Always check your plan’s formulary changes each year during open enrollment.

What if I take insulin? Are there special rules for generics?

Yes. Starting in 2023, Medicare caps insulin costs at $35 per month for all Part D plans - regardless of whether it’s brand or generic. This applies to all insulin types, including newer biosimilars. The $35 cap is separate from the $2,000 out-of-pocket cap, so your insulin payments don’t count toward it. This makes insulin far more affordable than other drugs.

How do I know if I qualify for Extra Help?

In 2025, you qualify if your income is below $21,870 for an individual or $29,580 for a couple, and your assets are under $17,220 (excluding your home and car). Many people who think they don’t qualify do. Apply through Social Security - it takes 10 minutes. If approved, you get $0 deductible, $0-$4.50 generic copays, and no coverage gap.

Can I switch my Part D plan anytime?

Only during the Annual Enrollment Period (October 15 to December 7) or if you qualify for a Special Enrollment Period - like moving, losing other coverage, or getting Extra Help. Outside those windows, you’re locked in. Don’t wait until you’re hit with a big bill. Review your plan every October.

Comments (13)