When you pick up a prescription, the price on the receipt doesn’t tell the whole story. You might think a generic drug is always cheaper-but in some cases, it’s not. The truth about what you pay out-of-pocket for medications is more complicated than it looks. It depends on your insurance, the drug itself, and even how the pharmacy and insurer share the cost behind the scenes.

Generics Are Usually Cheaper-But Not Always

Most of the time, generic drugs cost 80 to 85% less than their brand-name versions. That’s why nine out of every ten prescriptions filled in the U.S. are for generics. They contain the same active ingredients, work the same way in your body, and are just as safe. The FDA requires them to meet the same standards as brand-name drugs.

But here’s where it gets tricky: even though generics are cheaper, your out-of-pocket cost doesn’t always reflect that. In 2020, generics made up 90% of prescriptions but only about 18% of total drug spending. Why? Because brand-name drugs are priced so high that even when they’re prescribed less often, they soak up most of the money.

How Your Insurance Plan Changes Everything

Not all insurance plans are created equal. Two people taking the exact same drug can pay completely different amounts based on their plan’s structure.

If you have a flat copay-say, $10 for generics and $30 for brands-then rising drug prices don’t affect you. Your cost stays the same, no matter what the manufacturer charges. But if your plan uses coinsurance (you pay a percentage of the drug’s price) or a deductible, then every price hike hits your wallet directly.

For example, a 2021 study found that brand-name drug list prices rose by an average of 16.7% over two years. Patients with coinsurance saw their out-of-pocket costs go up with them. Those with flat copays didn’t. So if your plan is designed to shield you from price spikes, you’re lucky. If not, you’re paying the bill.

The Medicare Part D Trap

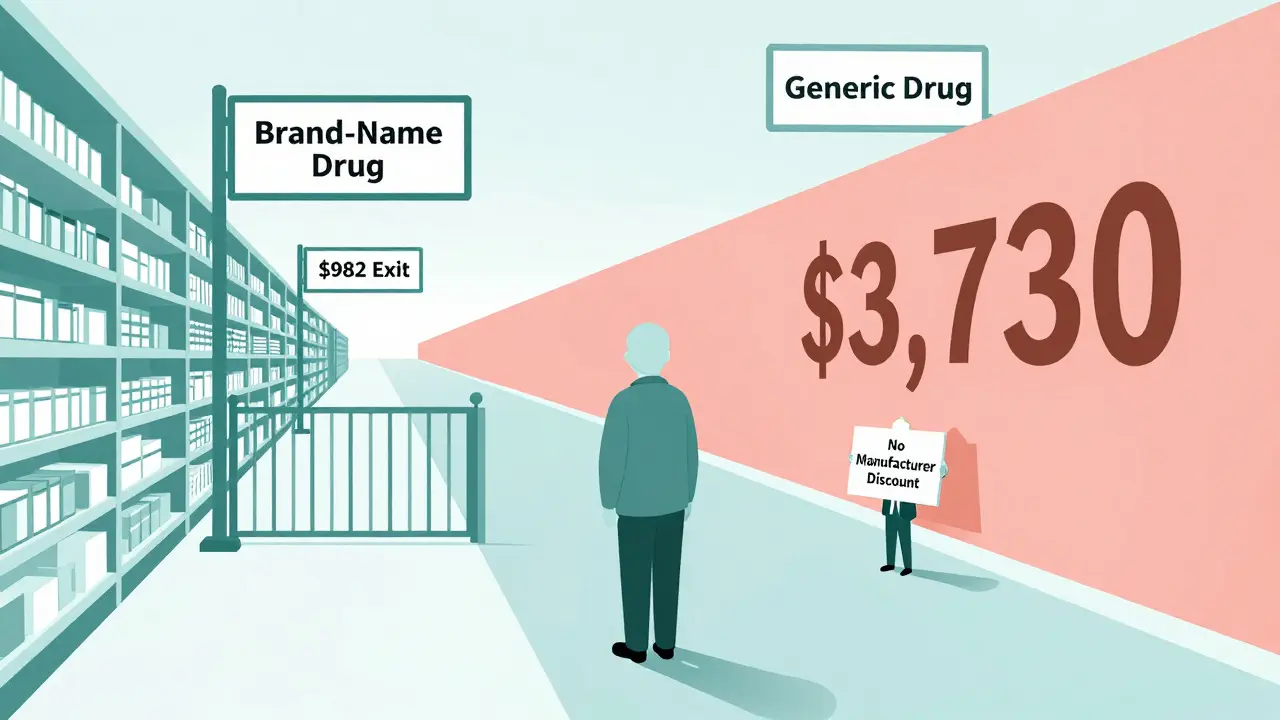

If you’re on Medicare Part D, things get even stranger. The program has a coverage gap-called the “donut hole”-where you pay more after hitting a certain spending threshold. Here’s the twist: brand-name drug manufacturers are required to give discounts in the donut hole that count toward your out-of-pocket spending. Generic manufacturers aren’t.

In 2019, if you were taking a brand-name drug, you only needed to spend $982 to get out of the donut hole and into catastrophic coverage (where you pay just 5% of the drug cost). But if you were taking a generic drug, you had to spend $3,730. That’s almost four times more. Even though the generic drug was cheaper, you had to pay way more out-of-pocket just to get the same level of protection.

This design means that in some cases, patients on Medicare Part D end up paying more for a generic drug than a brand-name one-not because the drug is more expensive, but because the system rewards brand-name manufacturers with discounts that help patients reach better coverage faster.

When Paying Cash Beats Insurance

Many people assume using insurance is always the best way to pay for prescriptions. But for generics, that’s not always true.

Companies like Mark Cuban Cost Plus Drug Company and Blueberry Pharmacy let you buy medications at cash prices-no insurance needed. A 2024 study found that for 11.8% of generic drugs, paying cash saved patients an average of $4.96 per prescription. For uninsured patients, the savings were even bigger. Medicaid patients saw no savings, but those with private insurance or Medicare often did.

Why? Because insurance companies and pharmacy benefit managers (PBMs) take cuts, negotiate rebates, and add layers of complexity that inflate prices. When you pay cash, you skip all that. You’re paying the actual cost of the drug, plus a small markup. In 2020, 97% of all cash payments for prescriptions were for generic drugs. That’s not a coincidence.

Why Some Generics Cost More Than You Think

Not all generics are created equal either. Some “generic” drugs-especially specialty ones used for complex conditions-are priced unusually high. Why? Because there’s little competition in the market. If only one company makes a generic version of a drug, they can set higher prices without fear of losing customers.

Plus, middlemen-like PBMs and wholesalers-often profit from a lack of price transparency. A 2022 analysis from the USC Schaeffer Center found that patients may be overpaying for generics by 13 to 20% because of these hidden costs in the supply chain. The drug’s sticker price doesn’t reflect what the pharmacy actually paid. And you’re the one footing the bill.

What You Can Do

You don’t have to accept whatever price you’re given. Here’s how to take control:

- Ask your pharmacist: “Can I pay cash instead of using insurance?” Sometimes, the cash price is lower-even if you have coverage.

- Use tools like GoodRx or SingleCare to compare prices across pharmacies in your area.

- If you’re on Medicare, check if your drug is affected by the donut hole. Use the Medicare Plan Finder tool to see how different drugs impact your out-of-pocket spending.

- Ask your doctor if they can write “dispense as written” on your prescription. That means the pharmacy can’t substitute a generic unless you agree. But if you’re trying to save money, you usually want the opposite-let them substitute.

- If a brand-name drug is expensive and you’re on insurance, ask if your doctor can file a prior authorization. Sometimes, insurers will cover the brand if the generic doesn’t work for you.

The Bigger Picture

The U.S. prescription drug system is broken-not because generics are bad, but because the pricing structure rewards complexity over fairness. Generics save the system $338 billion a year. In the last decade, they’ve saved nearly $2.4 trillion. Yet patients still pay more than they should because of how rebates, discounts, and insurance design are structured.

Policy changes are coming. Congress is considering capping out-of-pocket spending in Medicare Part D. The goal is to fix the donut hole imbalance so generics don’t punish patients financially. But until then, you’re stuck navigating a system designed to make it hard to know what you’ll pay until you get the receipt.

The bottom line? Generics are still your best bet for saving money-but don’t assume insurance will always help. Sometimes, walking out with cash in hand is the smartest move.

Are generic drugs really as effective as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also prove they work the same way in the body through bioequivalence testing. The only differences are in inactive ingredients like fillers or dyes, which don’t affect how the drug works. Studies consistently show generics perform just as well as brands.

Why does my insurance make me pay more for a generic than a brand-name drug?

This usually happens with Medicare Part D. Brand-name manufacturers pay discounts in the coverage gap (donut hole) that count toward your out-of-pocket spending, helping you reach catastrophic coverage faster. Generic manufacturers don’t offer those discounts. So even though the generic drug costs less, you have to spend much more out-of-pocket to get the same level of insurance protection. It’s a policy flaw, not a drug issue.

Should I always use my insurance to pay for prescriptions?

No. For generic drugs, paying cash through services like GoodRx or Mark Cuban Cost Plus Drug Company can sometimes be cheaper than using insurance. Insurance companies and pharmacy benefit managers often add hidden fees and negotiate rebates that don’t benefit you. If you’re paying a high coinsurance rate or your deductible hasn’t been met, cash may be the better option.

Can my doctor force me to take a brand-name drug?

Yes, but only if they write “dispense as written” or “do not substitute” on the prescription. Otherwise, pharmacists are allowed to substitute a generic unless you object. If you’re concerned about cost, you can ask your doctor to allow substitution. If you need the brand for medical reasons, your doctor can file a prior authorization with your insurer to get it covered.

How much can I save by switching to generics?

On average, you’ll save 80 to 85% per prescription. For example, if a brand-name drug costs $300, the generic might cost $45. But savings vary. Some generics are priced higher due to low competition or middlemen markups. Always check cash prices using apps like GoodRx-even if you have insurance, you might find a better deal paying out of pocket.

Are there any generic drugs that are always more expensive than brands?

Not usually, but in Medicare Part D, some high-cost generic drugs can lead to higher out-of-pocket spending than brand-name drugs because of how the coverage gap works. The generic itself may cost less, but since it doesn’t count toward the discount threshold like brand-name drugs do, you end up paying more overall before reaching catastrophic coverage. This isn’t about the drug price-it’s about the insurance rules.

Comments (12)